To find startup accounting software that will best serve your business at any stage, consider scalability as well as strong customer support. You will also want to choose software that uses the accrual basis accounting method for recording transactions. Manual data entry is prone to mistakes, leading to inaccurate reconciliation and financial reporting. By ensuring data accuracy, businesses can trust their financial reports and make better-informed decisions. Identify and eliminate line items that match the vendor statement and accounts payable records.

Who should prepare the account reconciliation?

Later that day, you get an urgent text from your bank that your account is overdrawn by $5,000. If you had performed regular bank reconciliations, you would have known about that check and to keep your eyes peeled for it. Reconciliation can help you monitor your cashflow so you have enough to cover your business needs. If there are any differences between the accounts and the amounts, these differences need to be explained. Reconciling your bank statements allows you to identify problems before they get out of hand.

- In fact, most jurisdictions have requirements for trust account reconciliation.

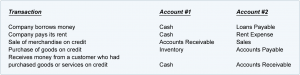

- This typically involves the entry of a transaction into the general ledger in 2 separate places.

- When the process has worked well, it will have picked up on any inaccuracies or instances of fraud.

- The documentation method determines if the amount captured in the account matches the actual amount spent by the company.

How Girl Scouts of the Green & White Mountains saved 20+ hours per month with Ramp

Make any required adjustments between the categories based on a calculation of short-term notes payable liabilities for the next 12 months to classify amounts in the categories as short-term or long-term correctly. The allowance for obsolescence and the inventory valuation at lower of cost or market are reconciling items to consider in the inventory recording and reconciliation processes. It’s also important to ensure you maintain detailed records of the three-way reconciliation accounting process. There are many types of reconciliation in accounting, with the best method for a situation generally depending on the type of account that you’re looking to reconcile. There are 5 main recognised kinds of reconciliation accounting that are industry-wide.

How HighRadius Can Help You With Account Reconciliations?

In business, this would typically mean debits recorded on a balance sheet and credits on an income statement. Using the double-entry accounting system, he credits cash for 20,000 ZAR and debits his assets (the car cleaning equipment) by the same amount. For his first job, he credits 5000 ZAR in revenue and debits an equal amount for accounts receivable.

Payroll reconciliation refers to the process of cross-checking the information and records supporting an organization’s employee compensation plan. It verifies the amount paid to the employees by comparing it to the already established compensation plan of the organization. This is done to double-check the math and ensure that the employees are being paid correctly. https://www.business-accounting.net/ is a crucial process that helps prevent accounting errors and financial losses, fraud, or other mishaps.

Reconciliation for businesses

It then makes sure that the purchase got logged correctly on both the balance sheet and income statement. So, the business records the purchase as a credit in the cash account and a debit to the asset account for reconciliation. Here, they’d match records like receipts or cheques with entries in the general ledger. This is a bit like carrying out a personal accounting reconciliation using credit card receipts and a statement. In general, reconciling bank statements can help you identify any unusual transactions that might be caused by fraud or accounting errors. Reconciling the accounts is a particularly important activity for businesses and individuals because it is an opportunity to check for fraudulent activity and to prevent financial statement errors.

Cash reconciliation, yet another type of reconciliation in accounting, refers to the process of comparing the external bank statements to the internal ledger entries of an organization. The core objective of cash reconciliation is to ensure the recorded fund balance matches up with the recorded bank balance. Bank reconciliation refers to the process by which a business compares its bank statements with the accounting records.

This is done either to identify any discrepancies or mismatches or to verify whether both are in perfect sync or not. Herein, the discrepancies (e.g., deposits in transit or outstanding payments), are usually treated what is fasb as timing differences. Many people may periodically reconcile their credit card and checkbook accounts by comparing their written checks, credit card receipts and debit card receipts with their statements.

This account is designed to temporarily store the monies being questioned to facilitate the resolution of the issue at hand. The balances in the two data sets must agree, and accountants must address any disparities in the account reconciliation statement. In this method, estimates of historical account activity levels and other metrics are used. It’s a statistical approach that helps identify whether discrepancies between accounts result from human error or potential theft.

The charge would have remained, and your bank balance would have been $2,000 less than the balance in your general ledger. Accounts like prepaid expenses, accrued revenues, accrued liabilities, and some receivables are reconciled by verifying the items that make up the balance. This may be done by comparing a spreadsheet calculation to the balance in the general ledger account. There’s no https://www.accountingcoaching.online/how-to-determine-an-assets-salvage-value/ annual fee, making it a cost-effective option for small business owners. It also includes benefits like free employee cards, fraud coverage, and year-end summaries, which can be valuable for managing business finances and monitoring expenses. Bank of America’s card lets you customize your rewards and offers additional cashback when you use a Bank of America business checking account.