When all the balance sheet accounts are reconciled, you’ve nailed net income. The reconciliation process includes reconciling your bank account statements, but it also includes a review of other accounts and transactions that need to be completed regularly. Today, most accounting software applications will perform much of the bank reconciliation process for you, but it’s still important to regularly review your statements for errors and discrepancies that may appear. Reconciliation in accounting is not only important for businesses, but may also be convenient for households and individuals.

QuickBooks Advanced

- You can gain complete visibility of incoming and outgoing money, and ensure your bank connections remain safe and secure at all times.

- No matter how diligent the accounting team is, sometimes a transaction just slips through the cracks.

- Once the accounts reconciliation is done, you can approve it electronically and keep the record securely in an online database.

- This process is crucial for identifying and correcting discrepancies, errors, or fraudulent activities.

- In such a situation, there can be inter-company deposits made, depending on the requirements of different companies.

The differences may sometimes be acceptable due to the timing of payments and deposits, but any unexplained differences may point to potential theft or misuse of funds. Conversely, identify any charges appearing in the bank statement but that have not been captured in the internal cash register. Some of the possible charges include ATM transaction charges, check-printing fees, overdrafts, bank interest, etc. The charges have already been recorded by the bank, but the company does not know about them until the bank statement has been received. Also, transactions appearing in the bank statement but missing in the cash book should be noted. Some of the transactions affected may include ATM service charges, check printing fees.

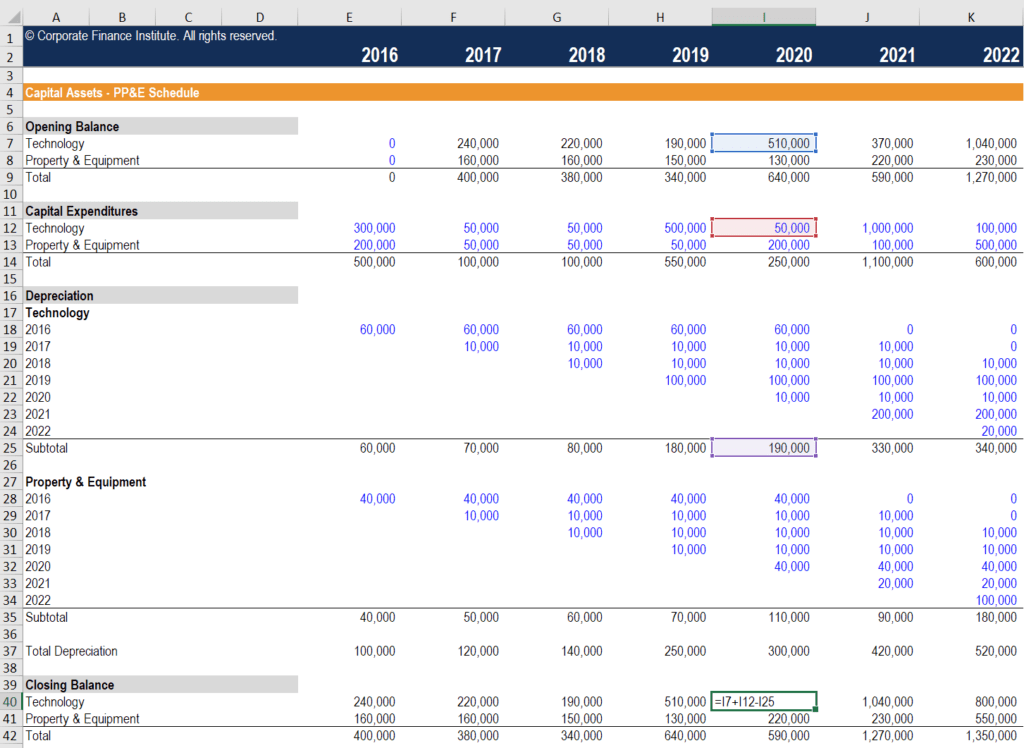

Reconcile With a Rollforward

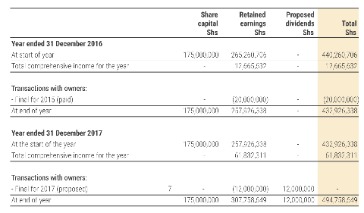

Be sure recurring journal entries and reversing entries have been completed. If you’ve ever been billed for an item you didn’t buy or found yourself with a larger bank balance than you know you should have, you understand the importance of account reconciliation. Capital accounts activity includes par value of the common stock, paid-in capital, and treasury share transactions.

Automated Reconciliation Is Best for Your Business

Accounting software automation and adding a procure-to-pay software, like Planergy, can streamline the process and increase functionality by automatically accessing the appropriate financial records. Invoice reconciliation is a great resource for weeding https://www.personal-accounting.org/how-to-categorize-credit-card-payments-in/ out errors or fraudulent activity, and also helps guard against duplicate payments. Invoice reconciliation usually involves two-way matching or three-way matching, which compares invoice details against a purchase order and shipping receipt.

There are many types of reconciliation in accounting, with the best method for a situation generally depending on the type of account that you’re looking to reconcile. In this method, estimates of historical account activity levels and other metrics are used. It’s a statistical approach that helps identify whether discrepancies between accounts result from human error or potential theft. Reconciliation is definitely not one of the most exciting tasks around, but there’s no thrill quite like spending hours — or even days — reconciling a beast of an account and getting the numbers to tie out perfectly. The key role that reconciliation plays in making sure your numbers are right means that anyone who works with financials needs to master the reconciliation process.

Easy to share information with your accountant and to find QuickBooks experts and online resources if needed. 95+ years of combined experience covering small business and personal finance. It presents information in graphs, charts and grids, enabling you to comprehend and convey financial details to stakeholders transparently.

Documentation review is preferred for its accuracy, relying on real information rather than estimates. Regular reconciliation helps spot any unauthorized transactions, preventing deceptive actions by team members or third parties. Starting with the ending balance of the prior period, you add all the increases and subtract all the decreases to get to the are retained earnings an asset ending balance. Accounts like prepaid expenses, accrued revenues, accrued liabilities, and some receivables are reconciled by verifying the items that make up the balance. This may be done by comparing a spreadsheet calculation to the balance in the general ledger account. A trial balance can tell you a lot about your business in a single glance.

Robust feature set includes thorough record-keeping, comprehensive reporting, excellent invoicing and inventory management, plus a capable mobile app. Reporting capabilities increase with each plan, but even the least expensive Simple Start plan includes more than 50 reports. To choose the right option for you, think about the present and future versions of your business — your accounting software should be able to support both.

However, you need to record financial transactions throughout the year in the general ledger to be able to put together the balance sheet. In the event that something doesn’t match, you should follow a couple of different steps. First, there are some obvious reasons why there might be discrepancies in your account. If you’ve written a check to a vendor and reduced your account balance in your internal systems accordingly, https://www.personal-accounting.org/ your bank might show a higher balance until the check hits your account. Similarly, if you were expecting an electronic payment in one month, but it didn’t actually clear until a day before or after the end of the month, this could cause a discrepancy. The accountant of company ABC reviews the balance sheet and finds that the bookkeeper entered an extra zero at the end of its accounts payable by accident.

The document review method involves reviewing existing transactions or documents to make sure that the amount recorded is the amount that was actually spent. For example, a company maintains a record of all the receipts for purchases made to make sure that the money incurred is going to the right avenues. When conducting a reconciliation at the end of the month, the accountant noticed that the company was charged ten times for a transaction that was not in the cash book. The accountant contacted the bank to get information on the mysterious transaction. If the indirect method is used, then the cash flow from the operations section is already presented as a reconciliation of the three financial statements. Other reconciliations turn non-GAAP measures, such as earnings before interest, taxes, depreciation, and amortization (EBITDA), into their GAAP-approved counterparts.

This year, the estimated amount of the expected account balance is off by a significant amount. A company may issue a check and record the transaction as a cash deduction in the cash register, but it may take some time before the check is presented to the bank. In such an instance, the transaction does not appear in the bank statement until the check has been presented and accepted by the bank. The analytics review method reconciles the accounts using estimates of historical account activity level. It involves estimating the actual amount that should be in the account based on the previous account activity levels or other metrics.